Review Account Security

Use our security tools in Online Banking to help protect your account

At RBFCU, we go beyond the standard security measures. Sign in to your Online Banking account or the RBFCU Mobile® app and select the “Resource Center” in the top right corner with the ? icon, then “Review Account Security.”

We’ll tell you what security measures you already have in place on your account, and which ones you can enable to make your account even more secure. See if you can get to 100%!

Learn more about our Online Banking security features

Set Up Multifactor Authentication (MFA)

Use an MFA code from an authenticator app in addition to your password every time you sign in to your account to greatly strengthen your account’s security.

Set Account & Loan Alerts

Monitor your RBFCU accounts and transactions with customized email and text Alerts. You’ll get notifications about transfers, loan payments, deposits, balance thresholds and more.

Set Card Alerts & Controls

Protect your credit or debit card by setting Spend Controls to limit or decline transactions, and Spend Alerts to let you know when certain transactions are made.

Review Trusted Devices

View the devices that have access to your Online Banking account, when they last signed in, and deactivate any that you no longer use or don’t recognize.

-

What should I do if I see suspicious activity in my Online Banking account?

If you see suspicious activity in your account that you didn’t authorize — such as notification that your password was changed or your contact information was updated — your Online Banking account may have been compromised. You should immediately contact RBFCU at 210-945-3300 for assistance.

If you’re still able to access your Online Banking account, report the unauthorized access to RBFCU and take the following steps:

- Sign in and check your account for any changes or transactions that you did not authorize — for example, changes to your email address or other contact information, or fraudulent transfers

- To check your contact information: Select the profile icon, then Profile Settings, then Contact Settings. Be sure to update any incorrect or outdated information

- Next, remove any devices with access to your account that you don’t recognize

- To deactivate a device: Select the profile icon, then “Profile Settings,” then “Security Center,” then “My Devices.” Select “Deactivate” under the device you want to remove

- Next, change your username and password. Get tips on creating a strong password here

- To change your username and password: Select the profile icon, then Profile Settings, then Security Center

- Enable multifactor authentication (MFA) for your account. Get directions for setting up MFA here

If you’re unable to access your Online Banking account, try the self-service options to reset your username and/or password. If you’re still unable to regain access to your account, contact RBFCU at 210-945-3300 or visit your nearest branch for assistance.

Additionally, you should monitor your accounts regularly and report any suspicious transactions.

- Sign in and check your account for any changes or transactions that you did not authorize — for example, changes to your email address or other contact information, or fraudulent transfers

-

How do I enable a lock screen on my device?

To enable a lock screen on your device,

- Open Settings on your device, and set a passcode, finger-swipe pattern, face or fingerprint that will be used to access your device when it’s locked.

- Restart your device.

- When your device restarts, you’ll be prompted to put in your new authentication to unlock it.

If you need further assistance enabling a lock screen on your device, click here for Apple® instructions and click here for Android™ instructions.

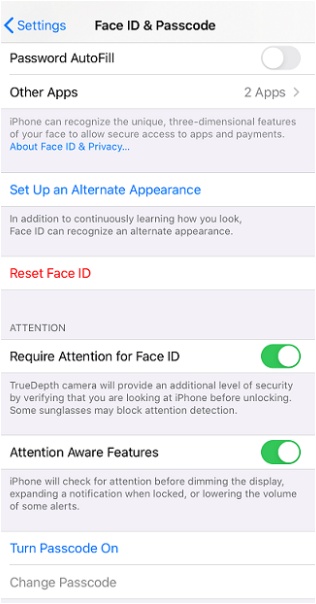

Where to set up a lock screen on an Apple device:

Where to set up a lock screen on an Android device:

-

What is multifactor authentication?

Multifactor authentication, or MFA, means providing two or more pieces of information in order to sign in to an account. You may also see this called two-factor authentication, or 2FA, when only two pieces of information are required. In most cases, this means you’ll need a one-time passcode (OTP) when you sign in, as well as the account password you’ve chosen. The code is sent to you via text message, email or phone call, or provided to you by another app, and typically expires after 30 seconds.

Combining a strong password with an OTP means it’s far more difficult for a fraudster to gain unauthorized access to your account with just your password, making MFA a highly recommended form of account security available for consumers.

-

How does RBFCU's MFA work?

To use MFA, you’ll need to download an authenticator app to your device. After you set up the authenticator app and enable MFA in your Online Banking account, RBFCU will use MFA to verify high-risk sign-in attempts. For example, if you get a new phone, RBFCU will prompt you to provide your MFA code the first time you try to sign in to your Online Banking account, just to make sure it’s really you. Asking for MFA in these situations lets RBFCU verify your identity, and gives us another line of defense in protecting your account from fraudsters.

You’ll also have the option to use MFA every time you sign in to your Online Banking account, which greatly strengthens your account’s security.

If you’re currently receiving an OTP code or answering a security question every time you sign in to your Online Banking account, enabling MFA will replace these sign-in options.

-

What authenticator apps will work with my Online Banking account?

RBFCU supports Microsoft® Authenticator and Google Authenticator™; choose the app you prefer.

iPhone Users: Download Microsoft Authenticator | Download Google Authenticator

Android Users: Download Microsoft Authenticator | Download Google Authenticator

If you’re already using one of these apps for another account, you’ll be able to add your RBFCU account to the existing app.

-

How do I set up MFA with an authenticator app for my Online Banking account?

To enable MFA for your account, sign in to your Online Banking account and visit the Multifactor Authentication page, or sign in to the RBFCU Mobile app.

- After you sign in, select the profile icon

- Select “Profile Settings”

- Select “Security Center”

- Select “Multifactor Authentication (MFA)”

- Under the “Authenticator App” section, select “Set Up Multifactor Authentication”

- You will be prompted for an OTP via text message or phone call to verify your identity. Select an option, then enter the code

- If you haven’t downloaded an authenticator app, you’ll be prompted to choose between Microsoft Authenticator and Google Authenticator. If you’ve already downloaded an authenticator app, select “Next” to skip this step

- On your device, add a new account in your authenticator app

- Then, scan the provided QR code or copy the 32-digit written code from your Online Banking account to verify your account in the authenticator app

- Enter the 6-digit code generated by the authenticator app in Online Banking, select “Enroll” to complete the setup and finally select “Submit”

- You’re done! You’ll receive a text message and/or email Alert to confirm your enrollment. On the success screen, you’ll be given a 16-digit recovery code. Save this code in a secure location so you’ll still be able to sign in to your Online Banking account in the event you lose access to the authenticator app — for example, if your device is lost, damaged or stolen

After enabling MFA, you can choose to be prompted for a 6-digit MFA code every time you sign in to your Online Banking account. This is optional — but highly recommended — since MFA greatly strengthens your account’s security. To manage this option, visit the MFA page in your Online Banking account.

Remember: RBFCU and RBFCU employees will never initiate a phone call, email or text message asking you to provide your authenticator code or recovery code. Do not provide these codes to anyone.

-

What is a trusted device?

A trusted device is an electronic device you frequently use (e.g., your mobile phone, tablet or home computer). It is a device we know is yours and that we used to verify your identity using Multifactor Authentication (MFA).

Visit the My Devices page in your Online Banking account to view your trusted devices and their recent sign-in history.

To view your trusted devices in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “My Devices” to see a list of devices with access to your account.

-

Why was I prompted to set up a trusted device?

As part of an ongoing effort to protect your personal and account information, we allow you to designate a trusted device you frequently use to access your account. Designating a trusted device provides an additional layer of security for your information.

-

I already have the RBFCU Mobile app. Why wasn't my device recognized when I tried to sign in to my Online Banking account?

If you haven’t signed in to your Online Banking account through the RBFCU Mobile app in some time, or you’ve recently uninstalled and reinstalled the app, your device may not be recognized. Simply respond ALLOW to the sign-in Alert and your device will be recognized the next time you sign in to your account.

-

I already have the RBFCU Mobile app, but my device wasn't recognized and I didn't receive an Alert when trying to sign in. What should I do?

If you’re trying to access your Online Banking account from the RBFCU Mobile app and you didn’t receive an Alert to approve the sign-in attempt, please review the following settings:

- Update the RBFCU Mobile app to the latest version: Visit rbfcu.org/update from your device to go to your app store. If you see an “Update” button, tap it to install the latest version of the app.

- Turn on push notifications for the RBFCU Mobile app on your device:

- For Apple users:

- From the Home screen, open the Settings app on your device.

- Scroll down to the list of apps at the bottom, and choose the RBFCU Mobile app (listed as “RBFCU”).

- Tap “Notifications.”

- Toggle “Allow Notifications” to on and set your preferences.

- For Android users:

- From the Home screen, swipe up to access “All Apps.”

- Find and open the Settings app.

- Tap “Apps.”

- Choose the RBFCU Mobile app (listed as “RBFCU”) from the list.

- Tap “Notifications.”

- Toggle “Show Notifications” to on and set your preferences.

- For Apple users:

- Opt-in to text messages: You may have opted out of text messages from RBFCU at some point. To opt in to RBFCU text messages, text START to 968772 and 839872. You’ll receive a confirmation letting you know you’ve successfully subscribed to RBFCU text messages.

If you need further assistance, please contact the Member Service Center.

-

I want to get rid of my device. How do I remove a device from my Online Banking account that should no longer be trusted?

Visit the My Devices page in your Online Banking account to remove a trusted device.

To remove a trusted device in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “My Devices.”

- Select “Deactivate” under the device you want to remove, and follow the prompts.

You may also deactivate a device from the device’s History page.

If you need additional assistance, contact the Member Service Center at 210-945-3300.

RBFCU does not charge a fee for the RBFCU Mobile® app, but you may be charged for data by your mobile wireless provider.

Enrolling in Alerts is free, but you may be charged for text messages by your mobile wireless provider. Alerts are a supplemental service and are not a replacement for responsible account review and management. You are responsible for any fees or charges incurred on your account whether you receive your Alerts or not.

RBFCU and RBFCU employees will never initiate a phone call, email or text message to anyone — members or non-members — asking for your sign-in information, including usernames, passwords, security questions and answers, multifactor authentication (MFA) codes, MFA recovery codes and one-time passcodes (OTP), or other personal information, like account, credit card, debit card or Social Security numbers. Also, RBFCU employees will never need to sign in to your Online Banking account on your behalf. If someone contacts you claiming to be an RBFCU employee and asks you to approve a sign-in request for them, do not respond.

If you receive a suspicious phone call, email or text message, hang up, do not respond to the message, do not click any links, and do not open any attachments. Forward any suspicious emails and text message screenshots to abuse@rbfcu.org, then delete the message. If you believe your account, username or password has been compromised, you should immediately contact RBFCU at 210-945-3300 for assistance. Additionally, members should monitor their accounts regularly and report any suspicious transactions.